tax avoidance vs tax evasion nz

In tax avoidance you structure your affairs to pay the least possible amount of tax due. Key Differences in Evasion Vs Avoidance.

Tax Evasion And Tax Avoidance Definitions Differences Nerdwallet

Tax avoidance is characterized as legal measures to utilize the tax system to discover approaches to pay the most reduced pace of tax eg placing reserve funds for the sake of.

. But tax evasion is illegal. Tax Evasion Tax evasion involves breaking the law not paying. Tax evasion on the other hand is when illegal tactics are used to avoid paying taxes such as hiding or misrepresenting income or intentionally underpaying taxes.

Tax avoidance is to avoid tax by doing some adjustments in accounts. People who cheat the tax system are tax criminals. Tax evasion includes underreporting income not.

Tax evasion is the use of illegal means for the tax. Pdf The Test For Tax Avoidance In New Zealand A Judicial Sea Change Tax avoidance is simply the process of reducing tax liability using legitimate ways. Tax avoidance is something the government encourages through tax incentives and credits whereas tax evasion can land someone in court.

To start with tax avoidance is legal while tax evasion is illegal. In tax planning a taxpayer is doing what the govt wants him to do whereas in tax. Part i tax evasion and general doctrines of criminal law 1996 2 nz j tax l policy 1 at 4.

How we deal with tax crime Were committed to. Now lets look at the illegal side of things. Tax evasion can lead to a federal charge fines or jail time.

Tax evasion is an intentional. Within recent time however there are cases where avoidance is declared as illegal. Main difference between tax avoidance and tax evasion.

The main difference between tax evasion and tax avoidance is that evasion is an illegal activity meant to deliberately dodge. Because you need to practice tax avoidance in this area too. There is tax avoidance or tax planning which is completely legal.

With regular amendments being introduced in the Tax Budget by the Govt it is very difficult for a person to do tax avoidance. Tax avoidance uses the loopholesweakness in tax statutes to reduce or avoid tax liability. What tax crime is Everyone pays tax on their income to help fund public services.

The difference between tax avoidance and tax evasion boils down to the element of concealing. Being convicted of tax evasion can have a variety of consequences from shortfall penalties to imprisonment13 B Tax mitigation On the opposite end of the scale to tax evasion is tax. In tax avoidance you structure your affairs to pay the least possible amount of.

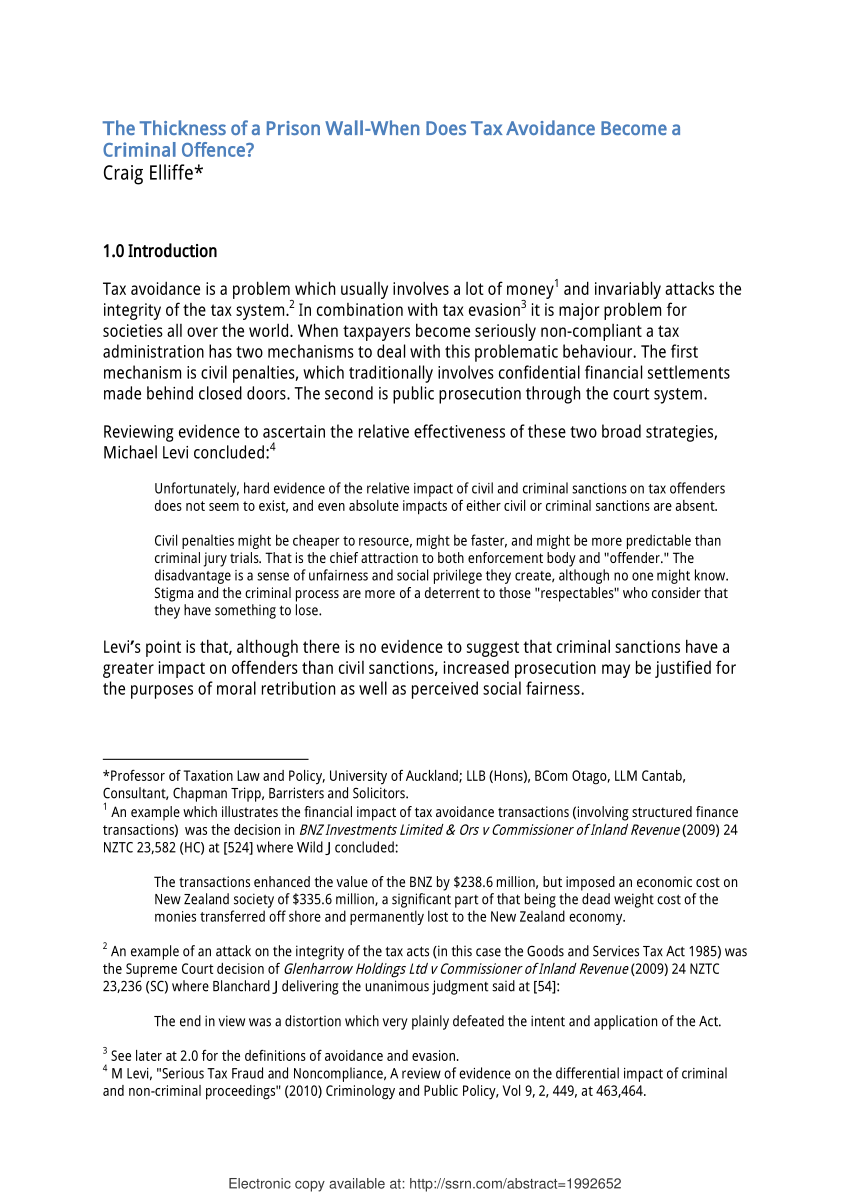

Pdf The Thickness Of A Prison Wall When Does Tax Avoidance Become A Criminal Offence

Without More Enforcement Tax Evasion Will Spread Like A Virus The New York Times

Tax Evasion V Tax Avoidance Is There A Difference Pace International Law Review

How Do Us Taxes Compare Internationally Tax Policy Center

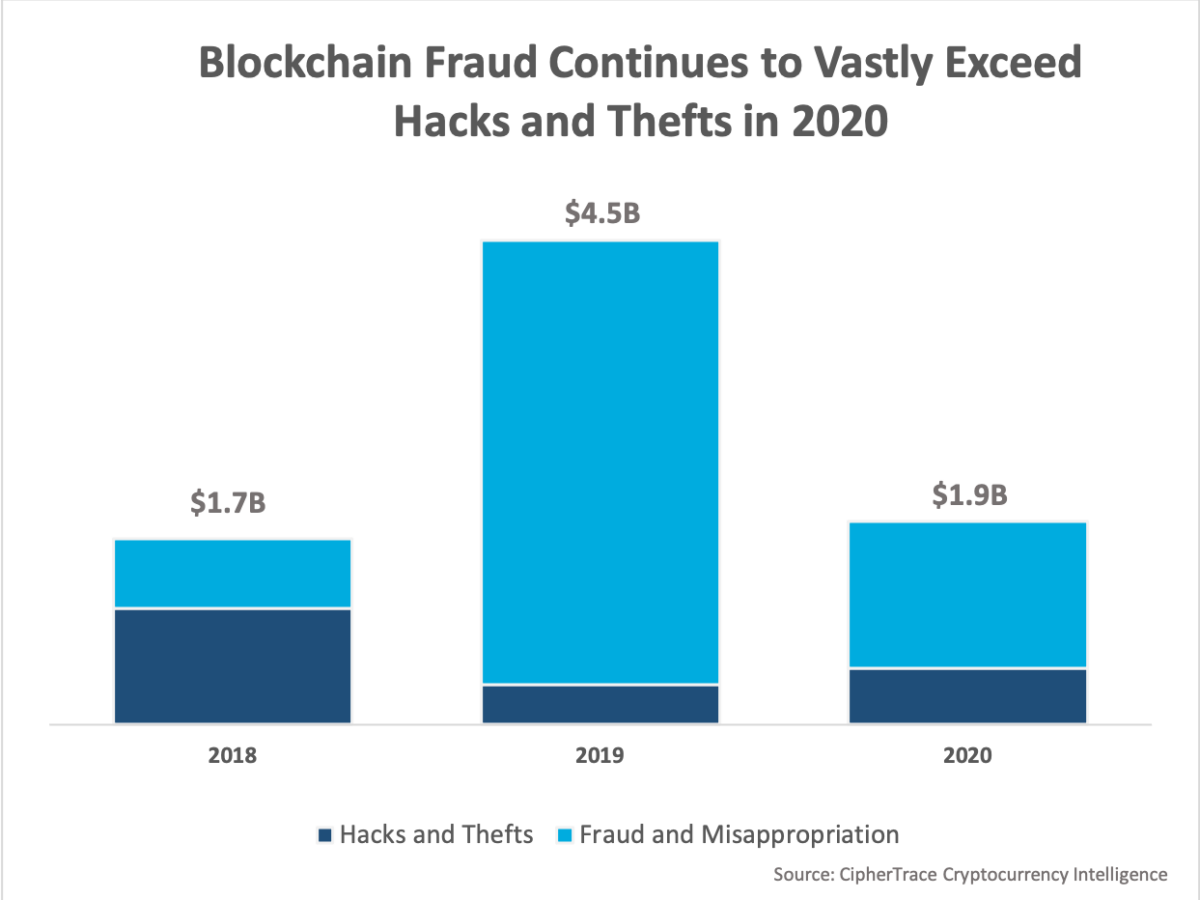

Cryptocurrency Crime And Anti Money Laundering Report February 2021 Ciphertrace

Tax Evasion Lobster T Shirt For Sale By Bilbo406 Redbubble Taxes T Shirts Tax T Shirts Tax Fraud T Shirts

The Pandora Papers Show The Line Between Tax Avoidance And Tax Evasion Has Become So Blurred We Need To Act Against Both

Tax Morale And International Tax Evasion Sciencedirect

Ending Offshore Profit Shifting Oecd

Ten Ways Hmrc Can Tell If You Re A Tax Cheat Financial Times

Difference Between Tax Avoidance And Tax Evasion With Comparison Chart Key Differences

Which Are The Causes Of Tax Evasion Inter American Center Of Tax Administrations

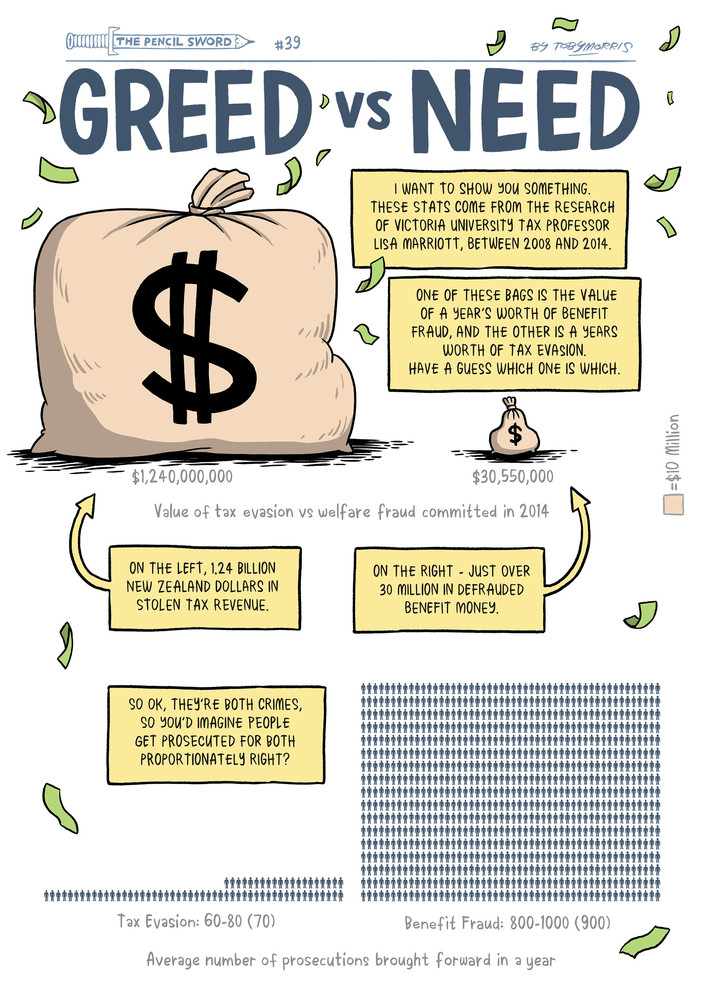

Official Information Act Request Tax Avoidance And Evasion Data 16 September 2016 Responses To Official Information Act Requests Stats Nz Store House

Tax Avoidance Is Legal Tax Evasion Is Criminal Wolters Kluwer

Environmental Regulation And Corporate Tax Avoidance Evidence From China Plos One