federal income tax amendment

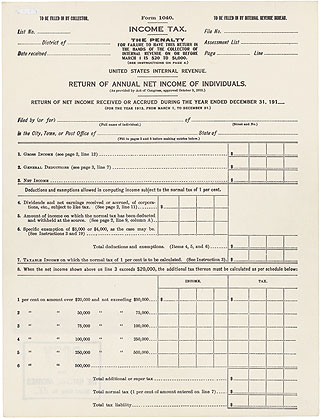

Individual Income Tax Return marked as an amended or corrected return not a Form 1040-X Amended US. Bear in mind that certain things have changed since the 2017 tax reforms.

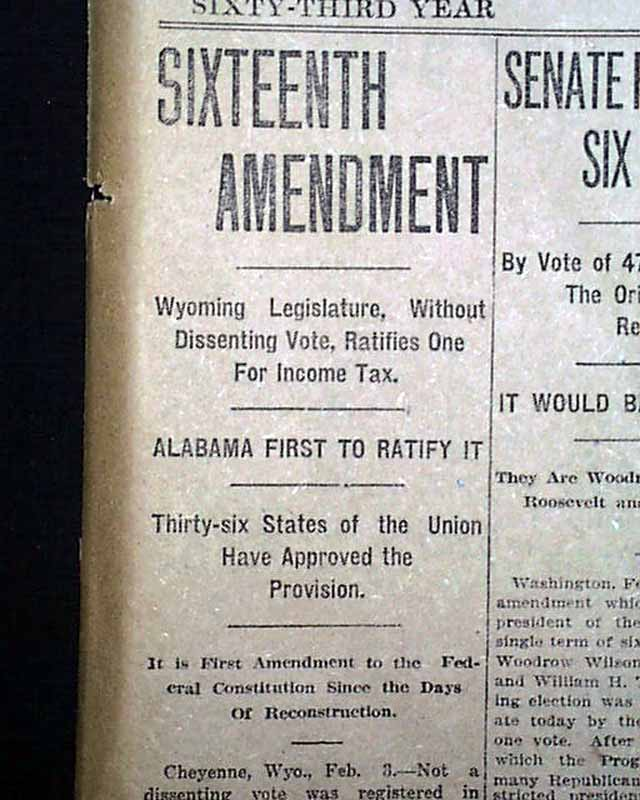

The Ratification Of The Sixteenth Amendment Us House Of Representatives History Art Archives

Individual Income Tax Return for this year and up to three prior years.

. Gather your original tax return and any new. Individual Income Tax Return using the Wheres My Amended Return online tool or the toll-free telephone. You can amend your state tax return in two simple steps.

Use this revision to amend 2019 or later tax returns. The Trump administrations tax reforms have capped how much individuals can deduct from. Pay additional tax owed as soon as possible to limit interest and.

For a 2021 tax return filed in 2022 the deadline was April 18 2022 and therefore 2021 amended returns have to be filed prior to April 18 2025. Individual Income Tax Return using the Wheres My Amended Return. But in 1913 when Congress passed an income tax law after the ratification of the 16th Amendment the tax burden shifted to the richat least for a while.

A Form 1040 US. Wheres My Amended Return. The process for filing an amended return is fairly straightforward.

Is available almost all of the time. When is Wheres My Amended Return Available. Federal Rules of Civil Procedure.

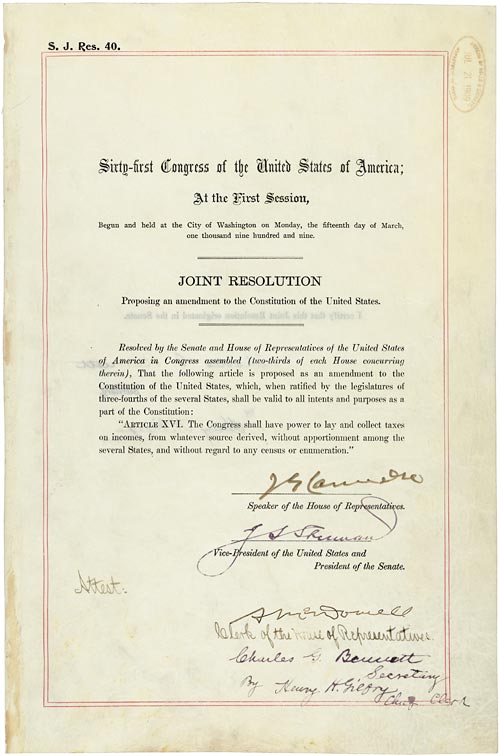

Heres a step-by-step guide. Constitution which was ratified in 1913 allows Congress to levy a tax on income from any source without apportioning it among the states. Federal Rules of Evidence.

File Form 1040-X to. First fill out an amended federal income tax return Form 1040-X. Today the law regulating the assessment and collection of federal income tax spans over 70000 pages.

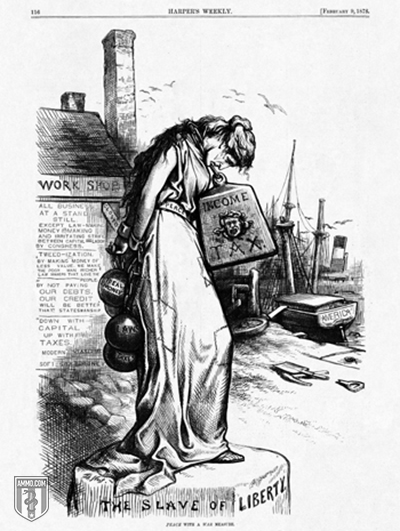

Roots of the Income Tax. Your amended return will. The 16th Amendment to the US.

Individual Income Tax Return An. Department of the TreasuryInternal Revenue Service. Federal Rules of Appellate Procedure.

Ratified in 1913 the 16th Amendment and its resulting nationwide tax on income. You can check the status of your amended return on the IRS Amended Return Status tool by clicking the button below and clicking on the Amended Return Status button. You can check the status of your Form 1040-X Amended US.

Second get the proper form from your state and use. Online tool or by calling the toll-free. Individual Income Tax Return.

The Sixteenth Amendment to the United States Constitution allows Congress to levy an income tax without apportioning it among the states on the basis of population. As a result you have no. Make certain elections after the deadline.

Wait if expecting a refund for the original tax return to be processed before filing an amended return. It was passed by. Federal Rules of Criminal Procedure.

Correct Form 1040 1040-SR or 1040-NR or older filings of Form 1040-A 1040-EZ or 1040-NR-EZ. The Congress shall have power to lay and collect taxes on incomes from whatever source derived without apportionment among the several States and without regard. However our system is not available every Monday early.

You can check the status of your Form 1040-X Amended US. Check the status of your Form 1040-X Amended US.

:max_bytes(150000):strip_icc()/tax-time-884732552-5b733c76c9e77c00507d453c.jpg)

The 16th Amendment Establishing Federal Income Tax

The 16th Amendment A Historical Guide Of The U S Federal Income Tax

16th Amendment To The U S Constitution Federal Income Tax 1913 National Archives

Graduated Income Tax Referendum Fails Dealing Major Blow To Pritzker Npr Illinois

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Paul Poast On Twitter The Federal Income Tax Officially Came Into Existence In 1913 With The Ratification Of The 16th Amendment To The Constitution Https T Co K6y7wb6omo Twitter

How To File An Amended Tax Return Forbes Advisor

16th Amendment To The U S Constitution Federal Income Tax 1913 And Resource Materials Pbs Learningmedia

How National Income Tax Began Under President Taft History

Introduction 16th Amendment Topics In Chronicling America Research Guides At Library Of Congress

Is U S Income Tax Invalid Because Ohio Wasn T Legally A State When The 16th Amendment Was Ratified The Straight Dope

Today S Document From The National Archives

16th Amendment To The U S Constitution Federal Income Tax 1913 And Resource Materials Pbs Learningmedia

16th Amendment To The U S Constitution The 16th Amendment Established Congress S Right To Impose A Federal Income Tax 1913 History Item Walmart Com

The Purpose And History Of Income Taxes St Louis Fed

Amendment 16 1913 It Gives The Federal Government Sutori

The Great Irs Hoax Why We Don T Owe Income Tax

How National Income Tax Began Under President Taft History

Understanding Taxes Theme 6 Understanding The Irs Lesson 1 The Irs Yesterday And Today